Saturday, April 26, 2008

Greenblatt Returns - March 2008

Jan 2008 MFI Return = -4.0% vs. Wilshire 5000 = -5.8%

Feb 2008 MFI Return = -0.2% vs. Wilshire 5000 = -3.6%

Mar 2008 MFI Return = +0.1% vs. Wilshire 5000 = -0.9

YTD 2008 MFI Return = -4.1% vs. wilshire 5000 = -10.0%

My MFI portfolio is currently 35% cash.

I did not make any changes to my MFI portfolio in March.

Current MagicFormula holdings:

3M (MMM)

Accenture (ACN)

Amgen (AMGN)

Applied Materials (AMAT)

Barr Pharmaceutical (BRL)

Cisco (CSCO)

Freightcar America (RAIL)

General Mills (GIS)

Hasbro (HAS)

Johnson and Johnson (JNJ)

Marathon Oil (MRO)

Microsoft (MSFT)

Pfizer (PFE)

Sara Lee (SLE)

Valero (VLO)

Verigy (VGY)

Monday, April 7, 2008

Double Bubble

One of his his suggestions is...

"The complex securities that are traded "over the counter" between banks, hedge funds and other players must be brought wherever possible onto exchanges, because this will reduce the pressure on the Fed to stage rescues. Bear Stearns was not too big to fail; it was, as The Economist has said, too entangled to fail: Its bankruptcy would have stranded holders of billions of dollars of its securities with nobody on the other side of their contracts. When trading moves onto an exchange, the exchange itself guarantees the contract. One impetus to Fed rescues can thus be neutralized."

The full article can be found here.

His book can be found here.

Saturday, March 29, 2008

Greenblatt Picks in the News

Hasbro: +10%

Accenture: -11% YTD

Amgen: -2% YTD

I suppose the only magic so far is that in aggregate they have fallen less than the market.

BestBuy is a MagicDilligence "Top Buy" and is also on the Greenblatt filter but I do not own it. BBY is highlighted both in Barrons here and in MagicDilligence here. BestBuy is down 24% YTD. Can it get any cheaper?

Letter to the Editor on Bear Stearns Bailout

Bear Hunt

To the Editor: Re: the Bear Stearns bailout ("The Deal -- Rhymes With Steal -- of a Lifetime," March 24).

The rationale is always the same: We will use any and all means to keep bankruptcies of banks from spilling over into the real economy.

For those of us who are not investment bankers, this requires some explanation. What is perfectly clear is that Ben Bernanke and Henry Paulson are using someone else's money to help bankers: our money.

By swapping U.S. Treasuries for dubious asset-backed paper, and by providing no-recourse rollover loans to Bear, and by flooding the world with ever more dollars, these gentlemen are diluting the dollar. This amounts to taking a little bit of value out of every dollar-denominated savings account to pay the bankers and brokers.

The argument is that if the government doesn't take these actions, Main Street will be hit much harder than in the devaluation of their savings accounts. However, this isn't an obvious proposition. If Bear goes belly-up, so what? Won't the world go on? Won't Bears' assets go into receivership, same as if anyone else goes broke? Those who invested foolishly will lose their money, and be smarter next time. That's market discipline.

I don't fear Bear's demise as much as I fear the actions of those who would raid everyone's savings and ruin the dollar in order to dump helicopter-loads of money on this Wall Street problem. They act as though they are rescuing the market, but in fact they seem to be rescuing particular individuals and firms. The market is always there. Bottom fishers come in and pick the bones.

What would be the consequences of Bear failing without intervention? How bad would that be? Could it be that the good doctors' medicines are worse than the disease?

Frederick W. Horn Glendora, Calif

Original found here.

Monday, March 17, 2008

Saturday, March 15, 2008

One smart woman

Stephanie Pomboy of Macromavens is one smart woman. Note the Feb 2005 date on this Barrons interview. Note she said to buy Gold which at the time of the interview was $420. Note what she said about credit drying up. Note what she said about the fed and the fed's actions to debase the currency and inflate away debt.

Stephanie Pomboy of Macromavens is one smart woman. Note the Feb 2005 date on this Barrons interview. Note she said to buy Gold which at the time of the interview was $420. Note what she said about credit drying up. Note what she said about the fed and the fed's actions to debase the currency and inflate away debt.Barrons remains a good place to get good ideas and hear from smart people.

Where to put one's money?

gives both the nominal (red - left scale) and real inflation adjusted (blue - right scale) prices. To quote from the article:

gives both the nominal (red - left scale) and real inflation adjusted (blue - right scale) prices. To quote from the article:"Housing does remain a good hedge against inflation over very long periods. Examine any 20-year stretch since 1970 and you'll find that home prices, adjusted for inflation, rose. Inflation-adjusted stock prices generally did even better over long periods, albeit with greater volatility, a Barron's analysis found. Surprisingly, commodities way underperformed both housing and equities as inflation hedges, notwithstanding the current run-ups in food, fuel and metals."

The full article can be found here.

Tuesday, March 11, 2008

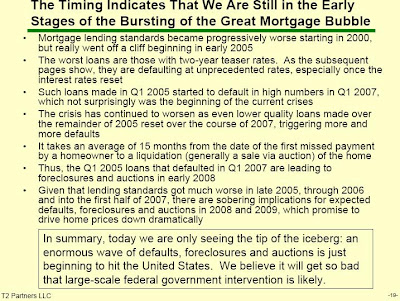

Housing mess

In summary...

Monday, March 10, 2008

My Greenblatt Holdings in the News

"March 10, 2008, 12:54 pm

Applied Materials: 2008 Could Be Huge For Solar Unit

Posted by Eric Savitz

Applied Materials (AMAT) could sign as much as $5 billion to $6 billion in contracts for solar cell manufacturing equipment in 2008, J.P. Morgan’s Jay Deahna asserts.

Last week, he notes, the company disclosed a $1.9 billion contract for solar manufacturing equipment and services. That deal alone is more than twice the roughly $900 million in solar contracts the company signed in 2007. Deahna thinks the company can get the total for this year over $5 billion with contracts from new customers in India and Europe, plus follow-on orders from existing customers.

Deahna today upped his price target on the stock to $28 from $22. “We see substantial stock price upside on potentially rapid ‘09 and ‘10 growth assuming solid execution/increased confidence in solar, completion of the re-org in silicon systems plus the likelihood of improving semi cap ex later in 2008 and into 2009,” he writes."

AMAT is up 1.3% today as I post this and up 7.6% since they announced booking the order on March 4.

Thursday, March 6, 2008

Stagflation

"Inflation is being driven by rising energy and food prices. Commodities—wheat, gold, oil, you name it—are getting more expensive. Another way of thinking about it, however, is that the dollar is losing ground against wheat, gold, oil, and other commodities. As the U.S. has pursued fiscal and monetary policies that debase the currency, the dollar has weakened significantly against many of the world's currencies. Consequently, when a commodity that is priced in dollars on a global basis—like oil—goes ballistic, the chumps who have all of their assets in dollars will get hurt disproportionately."

Full artucle here...

http://www.slate.com/id/2185919/

NewsWeek on Stagflation:

"Price increases of individual items can have many immediate causes: poor harvests for food; OPEC for energy; uncompetitive markets for health care; corporate market power for drugs; union market power for construction costs. But persistent inflation—the general rise of most prices—has only one cause: too much money chasing too few goods. It's not a random accident or an act of nature. The Federal Reserve regulates the nation's supply of money and credit. The Fed creates inflation and can control it."

Full article here...

http://www.newsweek.com/id/114803

Tuesday, March 4, 2008

Economic Meltdown?

http://pages.stern.nyu.edu/~nroubini/

He also runs a newsletter web site...

http://www.rgemonitor.com/

His web site is fee-based, but I found that someone has posted the contents of his Feb 5 newletter which has generated a stir in the press. It is titled:

"The Rising Risk of a Systemic Financial Meltdown: The Twelve Steps to Financial Disaster"

It can be found here...

http://www.tickerforum.org/cgi-ticker/akcs-www?post=27709

The followup article titled:

"Can the Fed and Policy Makers Avoid a Systemic Financial Meltdown"

can be found here...

http://www.tickerforum.org/cgi-ticker/akcs-www?post=28639

Very scary reads.

Monday, March 3, 2008

Random Reads

"At Berkshire we held only one direct currency position during 2007. That was in -- hold your breath -- the Brazilian real. Not long ago, swapping dollars for reals would have been unthinkable. After all, during the past century five versions of Brazilian currency have, in effect, turned into confetti. As has been true in many countries whose currencies have periodically withered and died, wealthy Brazilians sometimes stashed large sums in the U.S. to preserve their wealth.

But any Brazilian who followed this apparently prudent course would have lost half his net worth over the past five years. Here's the year-by-year record (indexed) of the real versus the dollar from the end of 2002 to year-end 2007: 100; 122; 133; 152; 166; 199. Every year the real went up and the dollar fell.

Moreover, during much of this period the Brazilian government was actually holding down the value of the real and supporting our currency by buying dollars in the market."

full article here...

http://online.wsj.com/article/SB120432105199503761.html

His full stickholder's letter can be found here...

http://online.wsj.com/public/resources/documents/berkshire2007.pdf

Slate on: Are foreclosures all badness?...

"After a foreclosure, one family moves out, and another moves in. We see the sad faces of the people moving out, but we don't as often see the happy faces of the new homeowners moving in. Nevertheless, those happy faces are out there, and we should not discount them.

That's important, and it's important in a larger context. Often when it comes to economic policy, some effects—in this case, the genuinely moving stories of good people who can't afford to live where they've been living—are highly visible, while others—the genuinely moving stories of good people who can now achieve their dreams of home ownership—are less well-publicized. That doesn't make them any less real."

full article here...

http://www.slate.com/id/2185303/

Barrons on: Bubble Headed Greenspan...

"DID ALAN GREENSPAN ONCE PROPOSE THAT ADJUSTABLE-RATE mortgages be sold more aggressively to the average homeowner? For this reader, at least, that was the most shocking charge of all in this indictment of the former Federal Reserve chairman, and it momentarily strained credulity.

But it's true. Authors William Fleckenstein and Frederick Sheehan introduce the damning quotes from Greenspan by informing us that "he told homeowners that they had been acting too conservatively." And while the reference to the audience's identity turns out not to be literally accurate, it is close enough."

full article here...

http://online.barrons.com/article/SB120432906225604319.html

.

New Yorker on: Homeownership can increase unemployment?...

"Homeownership also impedes the economy’s readjustment by tying people down. From a social point of view, it’s beneficial that homeownership encourages commitment to a given town or city. But, from an economic point of view, it’s good for people to be able to leave places where there’s less work and move to places where there’s more. Homeowners are much less likely to move than renters, especially during a downturn, when they aren’t willing (or can’t afford) to sell at market prices. As a result, they often stay in towns even after the jobs leave. That may be why a study of several major developed economies between 1960 and 1996, by the British economist Andrew Oswald, found a strong relationship between increases in homeownership and increases in the unemployment rate; a ten-per-cent increase in homeownership correlated with a two-per-cent increase in unemployment."

Full article here...

http://www.newyorker.com/talk/financial/2008/03/10/080310ta_talk_surowiecki

Saturday, March 1, 2008

I am now a blogger!

ALWAYS buy low and sell high!

Duuuh.

So for this first post I will highlight some RSS feeds at the bottom of this blog.

Bloomberg on the Economy hosted by Tom Keene is probably the best podcast site for discussions on the economy. The RSS feed at the bottom of this blog will list the most recent podcasts. Click on one and you can hear it through your PC. Or go to the links on the right of this blog to go directly to the site. If you have an MP3 player you can subscribe to the podcasts and listen to them when in the car. That's how I listen to them.

Bloomberg on the Economy hosted by Tom Keene is probably the best podcast site for discussions on the economy. The RSS feed at the bottom of this blog will list the most recent podcasts. Click on one and you can hear it through your PC. Or go to the links on the right of this blog to go directly to the site. If you have an MP3 player you can subscribe to the podcasts and listen to them when in the car. That's how I listen to them. If you follow the Greenblatt MagicFormula then the RSS feed from MagicDiligence.com is a useful site. The MagicFormula screens stocks strictly based on the "numbers" as value plays. The goal described on the MagicDiligence site is to further analyze the stocks on the Greenblatt screen...

If you follow the Greenblatt MagicFormula then the RSS feed from MagicDiligence.com is a useful site. The MagicFormula screens stocks strictly based on the "numbers" as value plays. The goal described on the MagicDiligence site is to further analyze the stocks on the Greenblatt screen..."What if you could pick and choose the best of the best, those select few “Magic Formula” stocks that were:

1) Financially healthy with strong, reliable cash flows, reasonable debt, and durable competitive advantages.

2) Are not the beneficiary of a one-time “fad” product.

3) Have experienced and trustworthy management, by all available indications.

4) Are not operating in a declining industry with poor future prospects."

One of MagicDiligence's recent top buys was HURCO. And... just a few days later it popped 34% in one day! So did I buy HURC when MagicDilligence highlighted it? If only I were that smart. In truth the MagicDiligence site is new so I thought I would watch it for a while to see what happens....

One of MagicDiligence's recent top buys was HURCO. And... just a few days later it popped 34% in one day! So did I buy HURC when MagicDilligence highlighted it? If only I were that smart. In truth the MagicDiligence site is new so I thought I would watch it for a while to see what happens.... The GuruFocus feed below highlights what top investors are doing, including... Greenblatt, Buffet, Pickens, Soros and more.

The GuruFocus feed below highlights what top investors are doing, including... Greenblatt, Buffet, Pickens, Soros and more.